What Is a "Volcker Moment"?

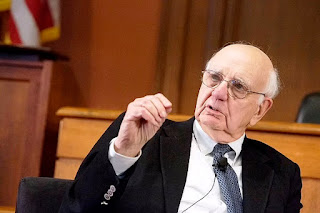

Who is Paul Volcker?

Paul Volcker headed the Federal Reserve from 1979 to 1987.

Paul Volcker took the stage again after the 2008 crisis. He also contributed to the way out of the crisis in the Obama administration. Volcker proposed the rules on the inability of commercial banks to make certain financial investments and use funds in the field of investment banking in the USA, and this was called the "Volcker rule".

What Is a Volcker Moment?

The year is 2022; Economic circles in the USA and around the world are talking about the "Paul Volcker moment".

During the energy crisis in 1973, inflation climbed to 12% in 1974 and fell to 5% in 1976. In the USA, during the second energy crisis in 1979, it rose to 14.6% in March 1980. When Paul Volcker took office in August 1979, inflation had risen to 12%. Volcker had raised the Fed Funds rate, the Fed's policy rate, by 10 percentage points to 19% by 1981.

While inflation was 'crushing', the unemployment rate in the US economy, which went into recession, had also skyrocketed from the 5-7.5% band to 10% in 1983. By August 1983, inflation had regressed to 2.4%. If the definition of 'crushing inflation' is to be made, Volcker has become a legend in this regard; criticized, even protested.

Why is the Volcker Moment being talked about today?

In an article published at the beginning of June, two economists, Marijn A. Bolhuis and Judd N. L. Cramer, along with economist Lawrence Summers, former US Secretary of the Treasury, argued that today's inflation in the US is close to that of the 1980s, and argued that monetary tightening on a Volcker-style scale would be required. In their paper, they arrived at this conclusion by recalculating historical inflation series from the 80s applying today's spending patterns.

With this calculation, they found that the core inflation, which was calculated as 13.6% in those days, was actually 9.1 percent. Considering that today's core inflation is 6.2 percent, they emphasize that a similar aggressive tightening is needed today.

Janet Yellen, the former Fed Chair and the current US Treasury Secretary, says that the emphasis on "inflation is temporary" in the official discourse a while ago is wrong and an 8 percent inflation is unacceptable.

In the forecasts for the Fed's interest rate path, the level of 2.50 percent was predicted. However, according to the rhetoric of "bringing it to a neutral level", it should be reduced to 4 percent. "Volcker moment" means a much higher level.

In summary, inflation is the main topic of the social and political agenda in the USA, and it is obvious that a tougher tightening is on the way.

The "Volcker moment" may not be far off.

About the Author

İlker ZORLU is a financial advisor, author and speaker who helps brands worldwide increase their financial analysis, planning and investment conversions. He has 18 years of international experience in Finance Specialization.

In June 2012, he graduated from Northeastern University in Boston, USA (25th best US business school by Bloomberg/Businessweek in 2013) and a 5-year dual degree training program from CEFAM International Business School in Lyon, France.

Yorumlar

Yorum Gönder